2020 was a year of big changes for Africa’s cloud ecosystem. There has been major investment into carrier-neutral data centres across the region. Meanwhile, the COVID-19 pandemic has sped up cloud adoption. Many businesses have turned to cloud services to help them operate in these difficult times.

Console Connect wanted to get a deeper insight into these trends. So, we asked consultancy firm Balancing Act to gather market research on the region’s data centre and cloud ecosystem.

Before we explore the results of this research, first we must put it in context. Four trends have affected the data centre and cloud sector at a global and local level:

The impact of the COVID-19 crisis has been huge. And it’s reinforced why flexible working capabilities are so vital. In national lockdowns, businesses have had to provide secure, hassle-free tools to access work and collaborate from home.

Some enterprises are taking a more cautious approach to the cloud. With bandwidth and security concerns, they are migrating parts of their service before making everything fully cloud-based.

There’s a growing level of digital disruption, both globally and in Sub-Saharan Africa. In 2019, $679 million was invested in African start-ups in the Fintech sector.

16 African countries had passed data protection legislation in 2019, with a further eight due to do so. These legislations will lead to growth in local data centre and cloud activity.

The more people in a country as its economy grows, the greater the level of economic activity. There are 15 African countries with large enough economies and populations for potential cloud and data centre development.

Having more operators in a country increases the need for interconnection via an IXP or a data centre, or both. South Africa most vividly illustrates this – it has four mobile operators, 11 MVNOs, over 160 ISPs. So, there are two IXPs and an exchange point that has 430 peering partners.

To develop a data centre and cloud services ecosystem, you need an open market attitude to regulation. On this basis, Ethiopia is entering new territory. It’s both liberalising its market and privatising its incumbent, Ethio telecom.

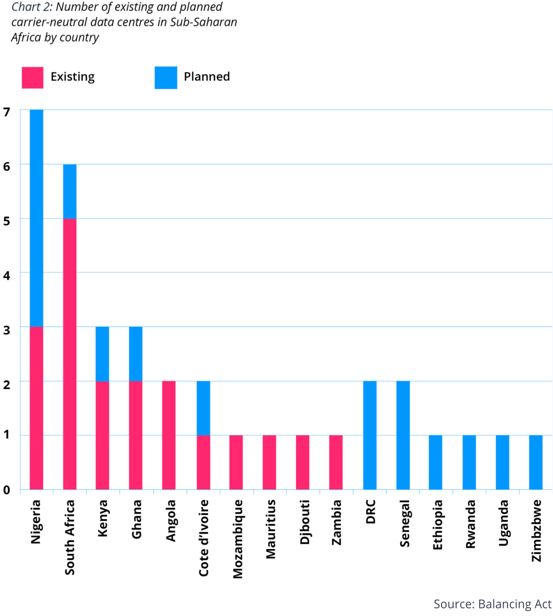

There are 10 Sub-Saharan African countries with carrier-neutral data centres (Angola, Cote d’Ivoire, Djibouti, Ghana, Kenya, Mauritius, Mozambique, Nigeria, South Africa and Zambia) and 6 more are coming on stream shortly (DRC, Ethiopia, Rwanda, Senegal, Uganda and Zimbabwe).

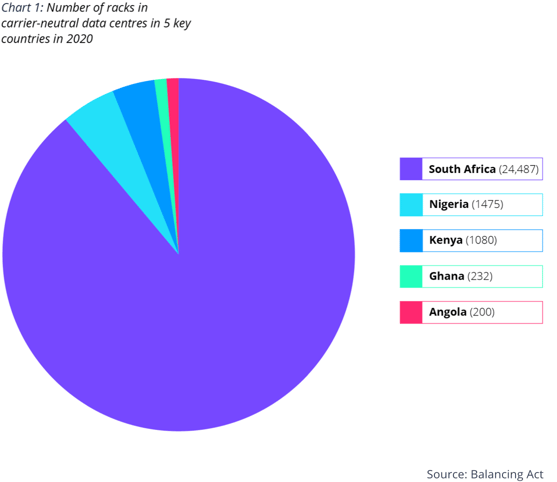

South Africa represents 89% of the total capacity in five key countries:

About a quarter of African countries have an existing or planned carrier-neutral data centre.

Across Sub-Saharan Africa, there are 20 carrier-neutral data centres and 15 planned new facilities. Some are in countries that already have a carrier-neutral data centre.

The quality and expertise of carrier-neutral data centres in Africa has greatly improved in the last five years. The first wave has now been operating successfully for nearly a decade. Many of the planned next-generation data centres are being built to Level IV standard. Several carriers – mainly mobile operators – have invested heavily in data centres. These include data centres of some scale in:

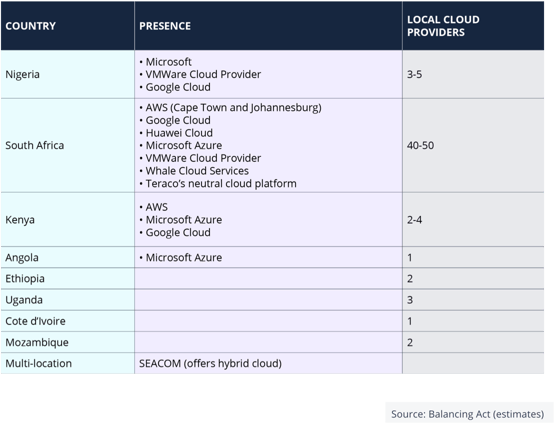

Five major hyperscalers have taken an active interest in Africa:

Hyperscaler and local presence by country:

Businesses across Africa are adopting data centres and cloud services at different speeds.

Banks were among the first wave of carrier-neutral data centre users

They’re under a growing legal obligation to have their disaster recovery outside their premises.

The second wave of users were multinational companies

These include everything from retailers and FMCGs to betting and insurance companies. They moved to the cloud for cost and operational efficiencies.

There is a significant overlap between data centre and cloud service users

African companies that use carrier-neutral data centres are looking to adopt more cloud services.

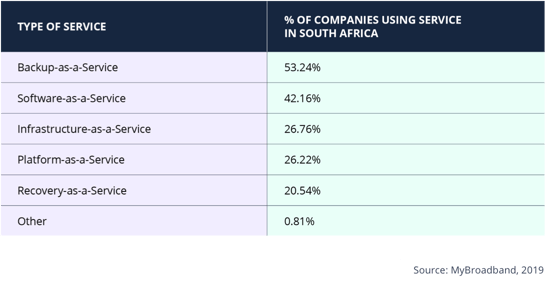

Companies in South Africa mainly use cloud services for:

Digital transformation is accelerating. And as more data centres and cloud service providers arrive in Africa, the need for local interconnection will increase.

Businesses across the region will grow more independent on a much larger pool of cloud, SaaS, and other services. They’ll require quick, instant access to data centres. And they’ll want their SaaS, cloud, and other critical services to interconnect seamlessly.

These are just some of the top-level findings from the research. Take a deep dive into our full report to learn more about:

Download your free copy of the Africa Interconnection Report today.

Create an account on Console Connect and get access to our interconnection pricing calculator.

REGISTER NOW

©2026 PCCW Global. All Rights Reserved.

Privacy statement

Terms of use

Cookie policy